As mandated by law, all individuals working in private institutions, self-employed and OFWs must have an SSS fund.

So what is SSS?

In layman's term, SSS is a form of contribution pool where an individual is regularly depositing funds into it. When he or she reaches the retirement age of 60 (60 years old is voluntary retirement | 65 years old is mandatory retirement), he/she can then claim a retirement pension which will be given every month up until the pensioner's death.

What are the other Benefits of SSS aside from pension?

The benefits are as follows (subject to change depending on the institution itself):

How can I avail?

As mentioned above, it is a mandatory contribution for all working employees. When you are hired for a job, the first task you need to tackle is to get the necessary government IDs. SSS ID is one of them, the others are TIN (Tax Identification Number) ID, PhilHealth ID, and HDMF (Pag-IBIG) ID. Secure these identifications first before embarking on a job hunt to avoid any inconvenience. If you are a private company employee, the contributions will be deducted automatically, you can check the deductions on your pay slips. No need to actually go to an SSS office and manually make the payment. However, if you are self-employed or an OFW, you need to manually process the payment.

How much is my contribution?

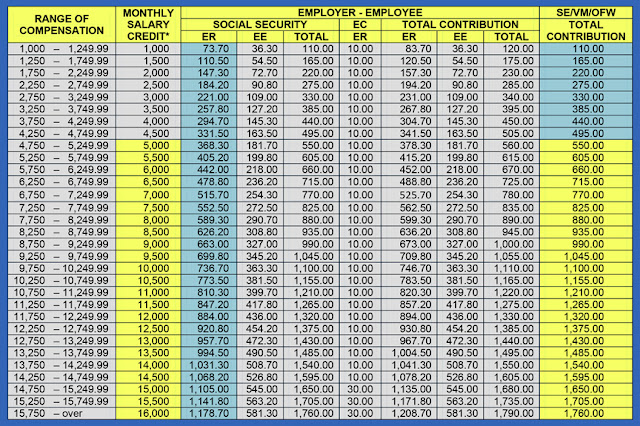

It really depends on your salary bracket and if you are a regular employee or self-employed. Below is the table of contributions:

|

| Image from www.sss.gov.ph |

There are only two columns of utmost importance if you want to know your contributions. First, is the Range of Compensation column. Second, is the Total Contribution column specifically the EE part of the table.

Example:

Your Salary is Php 13,500 per month. In the table, your salary falls within the range of Php 13,250 – Php 13,749. If you check across the EE column under Total Contributions the amount is Php 490.50. That will be your monthly contribution.

The table is very useful to avoid being duped by some shrewd companies who are not paying the correct amount for the sake of lowering down their business costs. If you are unsure, then check this table. Better yet, you can visit the SSS website https://sss.gov.ph/

In the next article, I will discuss the computation of how much will be your pension when you retire. Stay tuned!

Life In Perspective.